| 작성자 : 라키스 | 작성일 : 2021-04-05 14:58:39 | 조회수 : 2,412 |

|

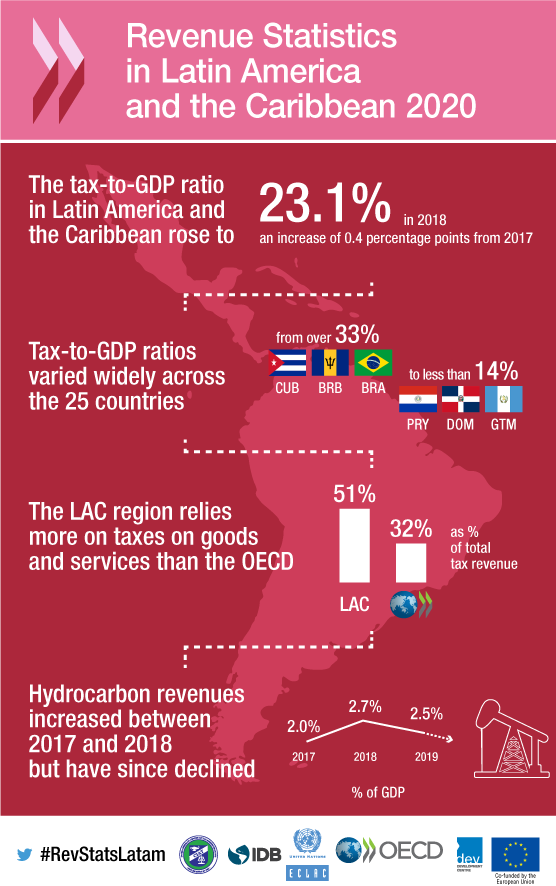

This report compiles comparable tax revenue

statistics over the period 1990-2018 for 26 Latin American and Caribbean

economies. Based on the OECD Revenue Statistics database, it applies the OECD

methodology to countries in Latin America and the Caribbean to enable

comparison of tax levels and tax structures on a consistent basis, both among

the economies of the region and with other economies. This publication is

jointly undertaken by the OECD Centre for Tax Policy and Administration, the

OECD Development Centre, the Inter-American Center of Tax Administrations

(CIAT), the Economic Commission for Latin America and the Caribbean (ECLAC) and

the Inter-American Development Bank (IDB). The 2020 edition is produced with

the support of the EU Regional Facility for Development in Transition for Latin

America and the Caribbean, which results from joint work led by the European

Union, the OECD and its Development Centre, and ECLAC.

|

||

| 첨부파일 : 68739b9b-en-es.pdf [42건 다운로드] | ||

| 이전글 | 브라질 인터넷 사용자 트렌드 구글 검색 (2017)_2 |

|---|---|

| 다음글 | E-COMMERCE GROWTH IN LATIN AMERICA |